INTRODUCTION

Bulgaria is situated in the south-eastern part of Europe and occupies the eastern part of the Balkan Peninsula. To the north it borders with Romania, to the west with the Republic of Macedonia and Serbia, to the east with the Black Sea, to the south with Greece and to the southeast with the European part of Turkey. The area is 111.000 sq km.

Bulgaria offers the lowest labour costs among the EU countries, government incentives for foreign investments and attractive corporate and income tax rates. The aforementioned facts attract and encourage the foreign companies to invest in Bulgaria.

Bulgarian economy suffered from the effects of COVID-19 level, however it demonstrated more resilience than most of its Western European neighbors.

Bulgaria is expected to receive EUR 6.2 billion over a period of 2021-2026 from the EU grant funds to improve the economy in the areas of green energy, digitalization and private sector development.

Bulgaria shall adopt Euro currency in early 2024 however even now the Bulgarian currency (BGN) is linked to the Euro on a fix rate, so there is no currency fluctuation risk.

There are no legal limits on foreign ownership, with some exceptions: foreign companies are given the same treatment as national ones and their investments are not screened or restricted.

The key sectors of Bulgarian economy offering interesting opportunities for foreign investors are:

- IT & GBS

- Automotive

- Electronics

- Health & Life Science

- Robotics & Mechatronics

- Manufacturing

BULGARIAN ECONOMY

According to the World Bank data Bulgarian GDP dropped by 4% in 2020 due to the pandemic which was still better than EU 27 average. The economy rebounded by 7.6% in 2021.

Figure 1: GDP growth and inflation in Bulgaria

Despite high inflation, economic activity continued to expand in 2022, supported by robust growth in exports and by wage and social transfer increases that compensated for increasing consumer prices. Labour shortages are significant, and unemployment remains low (around 5%).

The government supported the economy by introducing several support schemes including price caps on electricity, subsidies for fuel and tax cuts for gas and bread. Tax exemptions are implemented until mid-2023 and 2025 for some excise duties, while the other short-term measures have recently been extended until the end of 2022 with total costs of around 3.2% of GDP for 2022 as a whole.

Deteriorating of global macroeconomic conditions will result in lower GDP growth in 2023, however the quick recovery shall start in 2024 driven by EU funds absorption, notably RRF (Recovery and Resilience Facility), which shall support private and public investment.

Several economic analysts argues that the structure of the Bulgarian economy allows it to be less affected by economic crises. The main advantage of the Bulgarian economy consists in the export of critical products such as food, textile, metal and other materials products.

BUSINESS ENVIRONMENT IN BULGARIA

In the latest Doing Business Report from the World Bank, Bulgaria holds the 61st place rated higher than such popular investment destinations as India, Vietnam or Brazil and very close to Romania, Italy and Mexico.

Figure 2: Doing Business Score Bulgaria

COMPETITIVE ADVANTAGES OF BULGARIA

Bulgaria has multiple benefits to propose to foreign investors and remains an attractive destination for foreign investments. As a result, the inflow of FDI in Bulgaria surged in 2022 reaching 2.25 billion euro and almost doubled compared to 1.21 billion euro in 2021.

A lot of renowned foreign multinational companies have already selected Lithuania to set their shared services centers and manufacturing facilities. Praised for digital skills and gender equality at work, Lithuania is one of Europe’s leaders when it comes to jobs created by FDI projects.

The main factors favoring FDI in this country are listed below:

- Strategic geographical position: 5 Pan-European corridors cross Bulgaria, connecting Europe with the Middle East and Asia

- Well-developed infrastructure with foreign airports, sea and river ports

- Highly qualified pool of specialists with good language skills

- EU membership opening facilitated access to other EU states market and benefits from the EU FTA agreements

Besides the above-mentioned advantages, Bulgaria also offers to foreign investors benefits related to competitive prices for doing business (attractive costs of assets, utilities prices, office space rents and labour cost).

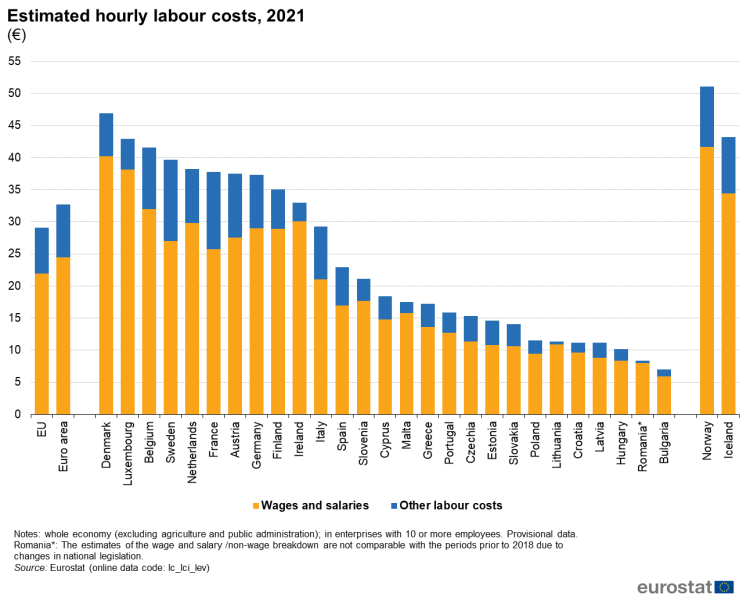

According to the recent Eurostat study, Bulgaria is the cheapest EU country in terms of estimated hourly labour costs.

Figure 3: Labour Costs Bulgaria

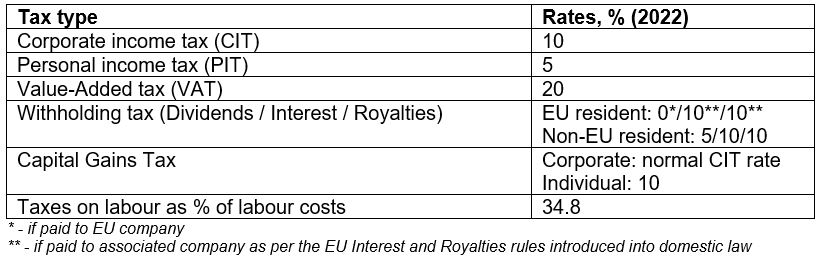

Favorable fiscal policy for business is another reason worth mentioning while investing in Bulgaria.

Below are listed the main tax rates applied in Bulgaria currently.

Figure 4: Tax Rates Bulgaria

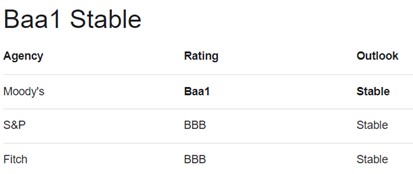

According to reputable rating agencies, Bulgarian financial system is stable.

Figure 5: Credit ratings of Bulgaria

Today Bulgaria offers to investors sustainable and predictable business environment, attractive fiscal policy, competitive labour costs and reliable financial system. The sum of these factors makes this country an interesting destination for Western European investors, which allows to shorten time-to-market and simplify supply chain.

Bulgarian government is aware of the importance of attracting of foreign investments in its economy and put in place several incentives to encourage the investors.

INVESTMENT INCENTIVES

The 2004 Investment Promotion Act (revised in 2018) stipulates equal treatment of foreign and domestic investors. The law encourages investment in manufacturing, services, high technology, education, and human resource development via a range of incentives, which include: helping investors purchase municipal or state-owned land without tender, providing state financing for basic infrastructure and for training new staff, and reimbursing the employer’s portion of social security payments.

There are 2 classes of eligible investment for investment support depending on the investment amount:

- Class A: min BGN 32 million (€16.3 million);

- Class B: min BGN 16 million (€8.2 million).

The incentives depend on the investment class and include:

- Financial aid for construction of physical infrastructure elements (Class A);

- Personalized administrative services (Class A);

- Financial aid for education of employees, hired as a result of an eligible incentive, for the obtaining of professional qualification (Class A and B);

- Faster administrative services (Class A and B);

- Sale or establishing against consideration of limited real rights on private state or municipal property, without a tender or an auction (Class A and B).

Investment incentives for priority investment projects:

- Opportunities for other forms of state aid, institutional support, public-private partnerships or joint-ventures.

Investment incentives for industrial zones:

- Different type of transactions between the investor and the legal entity established for the purposes of construction and development of industrial zones.

Tax incentives:

- Incentive for manufacturing activities in high unemployment municipalities.

The amount of the annual corporate income tax due by entities on their profits from manufacturing may be partly or fully reduced if the activities are carried out in municipalities with high unemployment.

There are a number of specific eligibility conditions for applying the incentive (including conditions imposed under the EU state aid rules).

- VAT Incentive for large investment projects

Entities investing in a large investment project can benefit from a faster recovery of VAT, temporary VAT exemption and self-charge of VAT on importation of certain goods.

There are a number of specific requirements for applying the VAT incentive, including the need of obtaining authorization from the Bulgarian Ministry of Finance.

SUCCESS STORIES OF FOREIGN INVESTORS IN BULGARIA

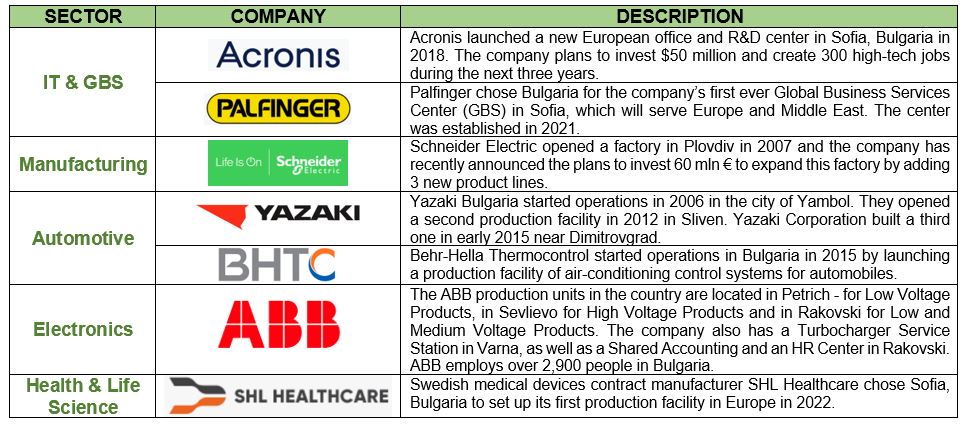

A lot of foreign multinational companies have already selected Bulgaria to set their shared services centers and manufacturing facilities. Find below several success stories of foreign companies in Bulgaria.

ABOUTS US

InterTrade Consulting is a French company with branches in Central and Eastern Europe which supports you on each stage of your investment project. To find out more about the investment opportunities in Central and Eastern Europe, do not hesitate to book your free consultation with us.