INTRODUCTION

Romania is often considered to be one of the most attractive countries for investments in Central and Eastern Europe. The country’s urban growth shows the efforts made by public and foreign investors in the development of Romania. Transport infrastructure is highly developed, logistics and distribution activities are efficient.

As a member of the European Union, since 2007, the country ranks seventh in the Union in terms of surface area but especially in terms of population. This means a dense and growing domestic market. This growing domestic demand also coincides with a very active manufacturing activity.

The big part of local production is made for export as it is strongly supported by foreign investments. It is assisted with a recognized automotive and electronic assembly industry. The energy industry is also an important part of the Romanian economy.

The country is rich in fossil resources, mainly natural gas and oil, from which it receives the majority of its energy (63%). However, renewable energies are not missing out. It is a sector in full expansion, driven by the commitments made by the public authorities for an energy and environmental transition. Today, renewable energies represent 24% of the electricity produced in Romania, and this share of the energy mix is set to increase in the years to come. Indeed, the potential for development in this area is huge (wind, photovoltaic, solar, hydraulic, hydrogen, biogas and biomass) and many foreign investors are targeting this market.

Romania is a country of considerable natural beauty, with numerous attractions for the visitor. It has seen significant development in the last three decades, particularly since EU accession in 2007. Romania enjoyed several years of strong economic growth before the pandemic, and there are already encouraging signs of a swift recovery and strong performance over the next few years.

ROMANIA’S ECONOMIC SITUATION

Romania is ranked 55 among 190 economies in the ease of doing business, according to the latest World Bank annual ratings.

The post-covid European economic recovery should give the country back its vitality. With a recovery in exports, economic growth should reach 4.9% in 2022, according to the latest estimates of the European Commission, after having reached 7.4% in 2021. The evolution of the inflation rate follows this course (2021: 3.2%; 2022: 2.9%) and similarly reflects a positive trend. The return of this foreign demand is essential, as the Romanian economy is so dependent on these trade flows. Indeed, its exports represent nearly 84% of its GDP. Germany, Italy and France are its main partners. Similarly, its imports are mainly coming from the European Union. In addition to this, there is a trend to relocate several productions and services of large Western companies to Central and Eastern Europe. The pandemic has confirmed the benefits of the strategy of nearshoring sourcing from the areas close to the centers of consumption and headquarters.

Romania remains an attractive destination from a foreign investor’s perspective and one of the most energy-independent countries in the EU. After a solid recovery from COVID the Romanian economy is also facing the negative effects of the conflict in Ukraine, including mainly a rising inflation.

According to the National Institute of Statistics, the GDP increased by 6.5 percent in the first quarter of the year, especially due to the impact of the high energy prices on energy consumers and as a result of the lifting of Covid-19 restrictions.

The gross fixed capital formation in Romania registered an increase of 5.2 percent sending a positive signal to the economy, being one of the highest growth rates in the EU. The growth was supported by a boosted activity in commerce, services and in the IT&C sector, thus compensating the decline in the industrial activity. However, private consumption remains an important driver of the economy growth.

The unemployment rate in Romania remained steady in both 2021 and 2022 after dropping from its highest levels registered during the pandemic year 2020.

Figure 1: Doing Business Score Romania

The main factors supporting the country’s economic growth in recent years were tax cuts, high direct investments by foreign companies and the current global economic trends, such as nearshoring and shortening of the supply chains.

ROMANIAN COMPETITIVE ADVANTAGES

In the dynamic world of business with paradigms of economic power being drawn and redrawn relentlessly, Romania keeps its position as a significant foreign direct investment destination in the CEE region.

As part of the EU, Romania represents an incredible market opportunity in terms of size and population, as the 2nd largest country in CEE and the largest in Southeastern Europe. Romania also benefits from another important international affiliation – NATO membership – being a pillar of strength and security in the region.

The country is rich in natural resources such as petroleum, natural gas, salt, coal, gold etc.

Romania has a healthy economy, companies in this country benefit from generous aid and a competitive tax scheme – one of the lowest flat tax, VAT and income tax rates in the European Union.

The friendly business climate stands for sustainable global competitiveness, being created to satisfy the international business community. A substantial network of 96 industrial parks across the country provides to investors suitable locations with access to utilities and benefit packages according to their focus.

Today Romania is considered to be a reliable country that has succeeded the reforms and transition period. The investors, which entered the local market over 15 years ago with basic manufacturing operations, are now developing more technologically sophisticated projects in Romania. The country stands as a benchmark for CEE region, a center of high competencies in the high-tech based global market.

Romania is the market having :

- strategic location

- huge development potential

- large pool well-educated workforce

- fiscal and employment incentives for companies

- numerous opportunities for foreign investors

The IT industry in Romania benefits from attractive investment incentives, e.g. employees from IT&C companies have 0% income tax rate.

The investment climate in Romania is quite good, as foreign investors still receive benefits from reduced labour and production costs, and a competitive tax system.

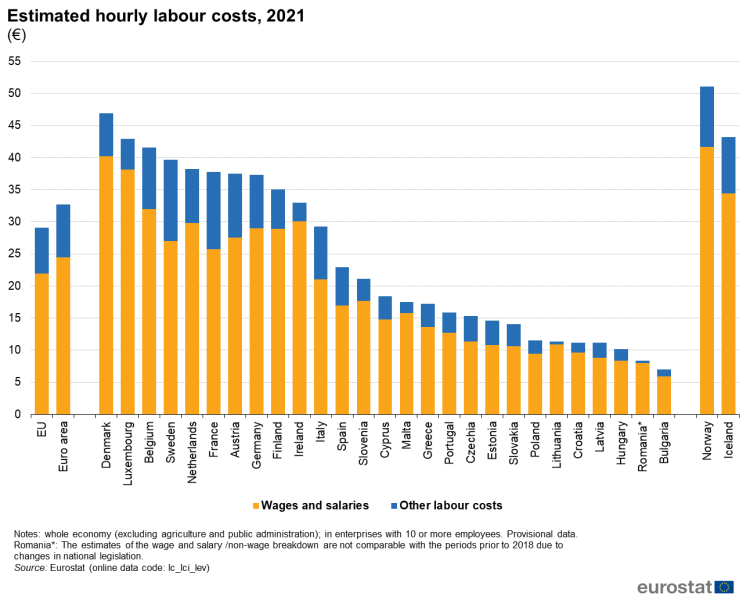

According to the recent Eurostat study, Romania is the 2nd cheapest EU country (after Bulgaria) in terms of estimated hourly labour costs.

Figure 2: Labour Costs Romania

FISCAL AND INVESTMENTS INCENTIVES IN ROMANIA

The Romanian government enacted a special law in 1991 that would regulate the FDI in the country. The law is very attractive for investors. According to the law foreign investors are provided with several financial benefits in terms of taxes, loans and benefits on investment in real estate.

The Romanian Government set the flat rate of corporate tax at 16%, which is one of the lowest in the EU and greatly benefits the foreign investors.

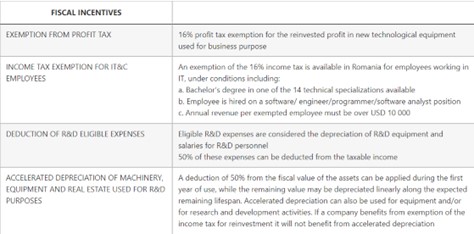

The government of Romania offers a number of fiscal and employment related incentives that are aimed at leveraging the local technology and R&D capabilities by incentivizing investors and employers.

Figure 3: Investment Incentives in Romania

SUCCESS STORIES OF FOREIGN INVESTORS IN ROMANIA

With a competent and well-educated workforce often having outstanding language skills, more and more investors are opting for Romania. The country has opportunities in any field, which are future-oriented and innovative.

The Renault Group, one of the most significant players worldwide, invested EUR 2.8 billion by the end of 2017 and hired 17,700 employees.

Daimler AG – one of the biggest manufacturer of premium auto vehicles hired more than 3,000 employees at its Romanian subsidiaries.

Continental is the largest German manufacturer of components for the automotive market, with an annual turnover of over 2 billion and over 16,500 employees in the country.

Italian steel group Beltrame plans to invest 250 million euros in the construction of an eco-factory specialized in part of its production for a future output capacity of 600,000 tons per year.

Information and Communication Technologies is one of the most attractive and rapidly growing sectors of the Romanian economy. According to a recent study by ANIS, the Employer’s Association of the Software and Services Industry of Romania, the Romanian IT market reached a volume of 9 billion EUR in 2021 and could exceed 12 billion EUR in the next two years. Compared to the general trend of economic growth in Romania, the IT segment’s annual growth rate is three times higher, at 15-17% per year.

Porsche Engineering, a branch of the German group is expanding its R&D and IT activities in Timisoara, a city where a polytechnic university campus is located.

Swiss-Swedish company ABB, which assists the digital transformation of industries, relies on the expertise of several Romanian subcontractors and suppliers.

French telecommunication giant Orange benefits from experience of its Romanian IT team.

Microsoft Corp, the most popular producer of software in the world, is present on the market since 1992. Currently, the company hires 760 employees and plans to expand to over 1,000 in the next 2 years.

The Integrated National Energy and Climate Plan (PNIESC) was approved in the Cabinet meeting on October 4, 2021.

Romania aims, through PNIESC, to increase the share of energy from renewable sources in total energy consumption by 2030 by increasing the installed capacity of wind and photovoltaic power plants, as well as by increasing the number of prosumers.

Through investments, by 2030, our country must have net installed capacities of 5.1 GWh of solar and 5.3 GWh of wind. In total, Romania thus should install additional capacities of 6.9 GW from renewable sources in the period 2021-2030.

Recent changes in the energy legislation notably for corporate PPA facilitation aim to support the gevernment ambitions.

Therefore, Romania is again returning to the agenda of large international RES companies.

The Balitc INVL Renewable Energy Fund I managed by INVL Asset Management has concluded an agreement on the acquisition of a solar farm project in Romania with a capacity of 174 megawatts (MW).

Portuguese renewable energy group EDPR, obtained the technical approval to connect to the grid for a 226.5 MW wind project in Romania.

Megalodon Storage, a Romanian company controlled by Austrian investors, obtained a permit to build an electricity storage facility with a maximum power of 7 MWn located in the village of Căciulați, north of Bucarest.

ABOUTS US

InterTrade Consulting is a French company with branches in Central and Eastern Europe which supports you on each stage of your investment project. To find out more about the investment opportunities in Central and Eastern Europe, do not hesitate to book your free consultation with us.